What Out-Of-State and Overseas Investors Need to Know about Developing and Investing in Florida Real Estate

We all seek to increase our wealth. It can give us the lifestyles we desire and be a shield against certain adversities. The problem is that wealth is scarce: More than half of the world’s adults have a net worth below $10,000. So how does one create or find wealth?

Real estate is an enduring way to tackle this problem even in today’s crazy markets. Just look at the ultra-wealthy: Real estate accounts for 11% of the total investment holdings according to a report by the global investing firm KKR. Real estate provides cash flow, a long-term hedge against inflation, and some remarkable tax benefits. Even better, you can use other people’s money to acquire these assets in the form of loans. What’s not to love?

The obvious downsides are the hassles of management. Tenants can be non-cooperative, contractors can be fickle, and you never know what governments will do. Out-of-state and foreign investors are especially vulnerable to these risks due to their inability to be onsite. But we have solutions for you–more on that to come.

For right now, let’s talk about Central Florida, one of the best real estate buying opportunities for those who have access to the right resources. Here’s why:

- The population is growing

- The economy is diversifying

- Florida continues to be a landlord-friendly state

Florida is blossoming and will continue to attract families and investment from Latin America, Europe, and the rest of the Eastern Seaboard.

“The best time to plant a tree was 20 years ago. The second best time is now.” – Chinese Proverb

My business partner and I have spent a lot of time preaching our message to potential investors. The overwhelming majority have the same response: “We agree, but is right now really the time to buy?” The answer is a resounding, “YES!”

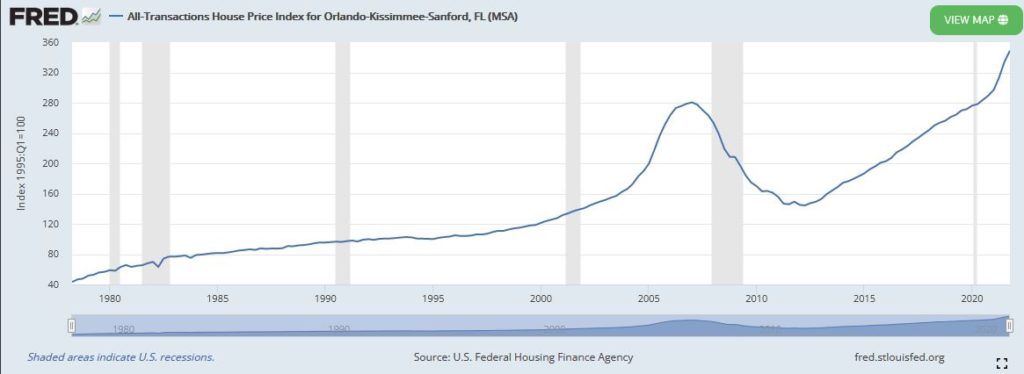

https://fred.stlouisfed.org/series/ATNHPIUS36740Q

As illustrated above, house prices have steadily increased over the last 40 years in Central Florida. The best-case scenario would have been a long-term buy-and-hold where your property values would have increased 9x over time. The worst-case is that you bought at the peak of the housing bubble in 2007 and still made off with 22%+ returns today. This does not take cash flow and tax benefits into account. Either way you cut it, real estate is always a good idea.

You Need Less Than You Think

Buying an investment property does not necessitate a full cash offer and there are loans to suit every buyer. A conventional investment property loan requires a down payment anywhere from 15% to 30% of the purchase price plus any closing costs (see our Guide to Buyer Costs).

In a market where investment-grade houses average $300k, you are looking at as low as $60k to get started. Conventional loans suit most needs. If circumstances require alternative financing, there are lenders available through non-conforming loans. These loans have different criteria for approval and tend to be a higher risk for the lender.

For that reason, these types of loans tend to incur higher interest rates and require larger down payments. That should not dissuade you from investing. These loans still provide access to real estate assets and profitable returns.

Everyone Can Buy

You do not have to live here to take a piece of the pie. Owning real estate can be done efficiently and securely from out of state or out of the country. The key is finding your trusted partner in business. Armas Realty and Blü Waters Property Management are set up to maximize your returns while making sure your property is in trusted hands. Our pricing is commission-based. If you do not make money, neither do we.

Our systems prioritize transparency through timely statements and detailed reporting standards. You will always know what is going on with your investment. We also have a network of lawyers, public adjusters, tax professionals, and contractors. So if something goes wrong, you will not be left in the lurch.

Our whole model is designed to be plug-and-play for our customers. Our goal is to reach 1,000 doors under management in three years. That means we are dedicated to creating trustworthy relationships and returning customers.

Real Estate is an Essential Asset Class

We will leave you with this story from investor Barbara Corcoran:

“Buying real estate has made me rich — mostly through necessity, not by design. I bought my first itty-bitty studio after scraping together a few bucks because I needed to live somewhere anyway.

A few years later, the studio doubled in value, giving me enough cash to plunk down 50% on a one-bedroom apartment. That soon rolled into a two-bedroom, then a three-bedroom, and finally landed me in my 10-room penthouse on Fifth Avenue in New York City.

Buying that tiny studio was the most important decision I made because it got me in the game.”

—Barbara Corcoran, founder of The Corcoran Group, podcast host of “Business Unusual,” judge on “Shark Tank”

We are always here to discuss your investment needs. Just set up a call with us.

Shantel Jairam