Buyers: Ask for seller concessions. Sellers: Hold the line.

As the real estate market conditions continue to change, Armas Realty has been closely monitoring important metrics to ensure we are properly advising our customers. We primarily focus on four metrics: home prices, days-on-market, the total number of housing units sold, and inventory.

Many Floridians and out-of-state buyers speculated that Hurricane Ian would cause property values to drop. Although many areas are still recuperating from the storm, property values remain strong and, in many cases, have continued to appreciate year-over-year.

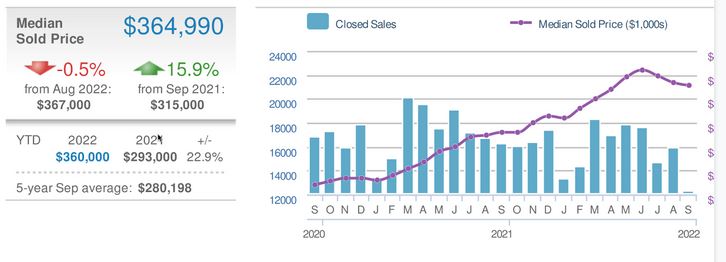

Home Prices

Despite changes in the real estate market and the aftermath of Hurricane Ian, home prices continue to stand strong in Central Florida. Most agree that we have hit the peak of home appreciation rates, but keep in mind that appreciation rates are different from home prices.

Home prices for the majority of our area should not experience a price drop. For September 2022, the median sold price for the region saw a decline in prices from the previous month, but an increase of 15.9% from the previous year as shown in the picture below. The median sold price of residential properties increased from $315,000 in September 2021 to $364,990 in September 2022. It is expected that the increase in prices will continue to slow down, potentially plateauing for the fourth quarter of 2022 and the first quarter of 2023.

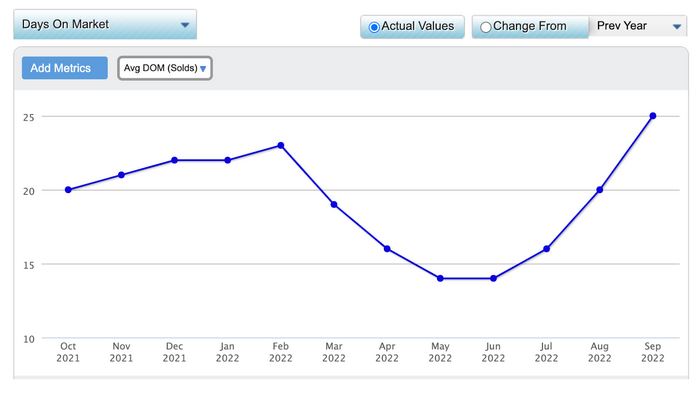

Days on Market

We have seen a steep increase in the days on market for the region. In September 2022, the average days on market was 25 days, an increase from 14 days in June 2022. As small as this change may seem, if this trend continues, it will directly affect the other metrics we use in this analysis. As homes stay on the market longer, competition will decrease, leading prices to plateau as demand catches up with a growing property inventory.

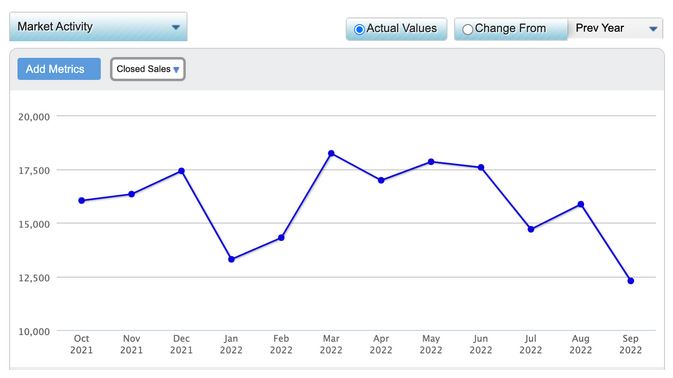

Total Units Sold

For September 2022, the total number of units sold was only 12,289, compared to August 2022, which had 15,862 total units sold, and September 2021, which had 16,228 total units sold. These numbers represent a drop in total units sold of -22.5% from the previous month and -24.3% from the previous year. This may be a direct result of increasing interest rates and consumers’ expectations that a price drop is coming.

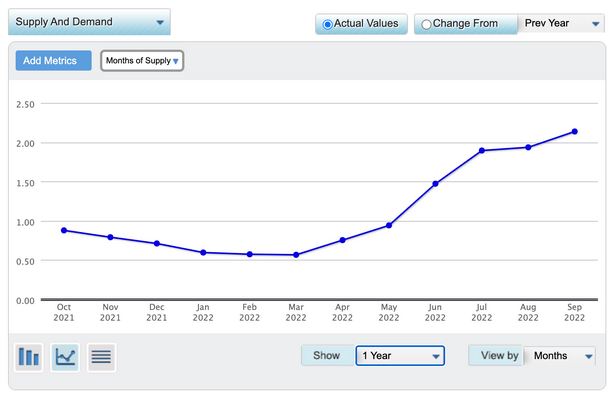

Inventory

The increase in interest rates and subsequent pricing out of many buyers from the market has led to homes lasting longer on the market and fewer units selling, which has positively correlated with inventory.

From May to September 2022, the region has seen an increase in home inventory from 0.94 months of supply to 2.14 months of supply. This is a 148.3% increase from September 2021.

In Conclusion

After much speculation and unexpected circumstances like Hurricane Ian, it is safe to say that the Central Florida real estate market is cooling off. However, despite many buyers hoping for a price drop, that does not seem to be one of the outcomes.

At Armas Realty, we are advising potential sellers not to wait much longer to list their homes. Even though they should not see their home values affected, the time it may take them to sell and the incentives it may take to get their home sold may increase as the year progresses. This will hurt their bottom line.

To buyers, we are advising them to make their purchase now if they can. Waiting will hurt their bottom line as well. If interest rates continue to trend upward, as has been the case this year, it will make their purchase pricier. We are already seeing sellers offering to cover some buyers’ closing costs.

Raidel Armas