Florida Trends in the August Real Estate Market

As our economy continues to experience high volatility, there is no question that changes are happening. It is important to remember that the real estate market is all about location: While one market in a region of the country may crash, other markets in other areas may flourish and continue to appreciate.

So what are some changes we have seen year-to-date in the greater Orlando and Tampa metropolitan areas?

Home Prices

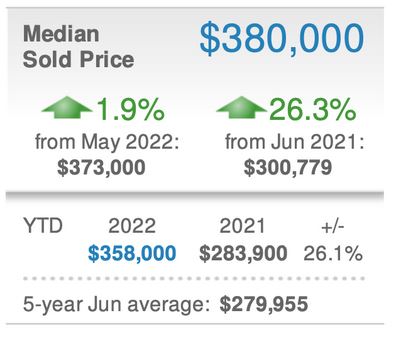

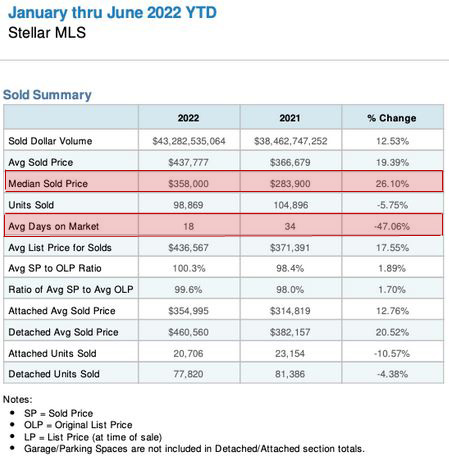

In the first half of 2022 (from January thru June), the market saw an increase in median sold price of 26.10% compared to the same time in 2021. The median sold price for the first half of 2021 was $283,900 in contrast to the increased median sold price of $358,000 in 2022. These numbers include the sale of all residential units.

We have been experiencing small declines in the month-over-month appreciation rates. Since January, the month-over-month appreciation was close to or above 3% per month. From May to June, however, the appreciation declined to 1.9%. According to Redfin Deputy Chief Economist Taylor Marr, “mortgage rates last month [June] shot up so fast between an offer and the close that buyers no longer could afford the home or qualify for the loan.” CITE

The increasing interest rates during the first half of 2022 seem to be the leading cause of a slowly decreasing appreciation rate. However, overall the numbers continue to be synonymous with a healthy real estate market that is far from a price decrease or even stagnation of home values.

Days On Market

Another pivotal variable we keep a very close eye on is the days on market. This number shows how quickly homes go under contract to sale after being listed. Compared to the first half of 2021, the first half of 2022 experienced a steep decline in days on the market of -47.06%.

In 2021 properties were lasting on average 34 days on the market. In the first half of 2022, the average days on market for all residential properties was only 18 days! Despite rumors of a shifting market, our region has actually been selling properties faster.

Total Units Sold

The only perceivable negative change we have seen this year in our market of a potential shift or price adjustment is the total number of units sold. We have seen a small decline in the number of units sold, specifically -5.75%. In the first half of 2021 total number of units sold was 104,896. During the same period of 2022, the total number of units sold was 98,869. This may be a direct result of the increasing interest rates and people’s response to rumors of a potential market crash approaching.

Inventory

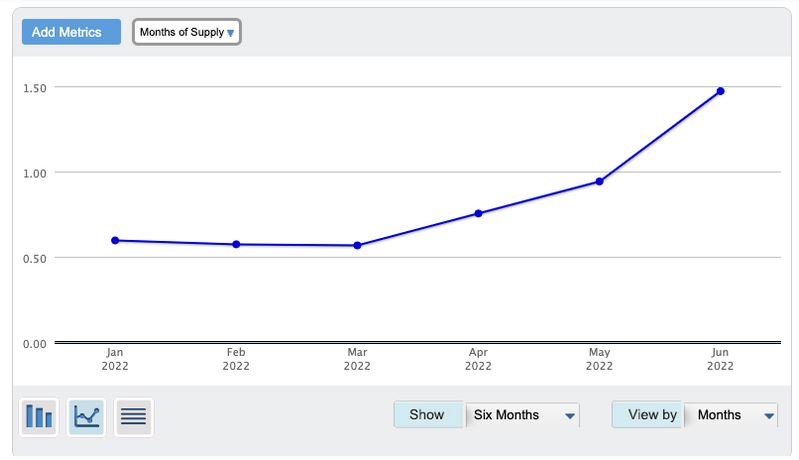

The last and the single most important variable is the inventory of properties. This means that if no new properties enter the market, it would take this period before the market dries up and no properties are left for sale.

According to Showingtime, a balanced market typically lies between four and six months of supply. The first half of 2022 has seen a slowly increasing inventory from .60 months (roughly 2 weeks) of supply in January to 1.47 months (roughly 6 weeks) of supply reported in June. This may result from the small decrease in the total number of units sold.

To conclude

We are living in an information-dense society, and it is easy to get lost in the noise. Many fail to understand that what differentiates the real estate industry from other sectors of the economy is that real estate has intrinsic value!

In the decade from 2010 to 2020 Orlando alone had a 29% population increase! “In the report done by 42Floors — a subsidiary of Santa Barbara, California-based real estate data firm Yardi — the former percentage ranked the city second among the country’s fastest-growing urban centers.” CITE Covid and the rise of remote work has accelerated this population influx to the state. The population increase and Florida’s landlord-friendly policies will continue to support our real estate economy. In fact, Redfin Corp. reports Orlando ranked seventh in the U.S. for the metros with the biggest proportion of investor home purchases in the first quarter [of 2022]: 25.7%. CITE

In a recent report conducted by Up for Growth’s they concluded that Orlando with its current population would need about 20,000 new homes to be able to meet the current shortage of houses in the region! This places Orlando 32nd in the U.S. for shortages of houses. CITE

What does this all mean? As our population increases and investors continue to see the value in Florida’s real estate, the demand for housing will persist. We predict that inventory will continue to increase slowly to somewhere between two and three months. This will lead to a slower appreciation rate potentially around 15% by the first half of 2023.

Raidel Armas