Real Estate Market Projections for Spring 2022

For more than a decade, our communities have been permeated with the pervasive expectation that the real estate market will crash as it did in 2008. Many are continuing to hold off their purchase until this time comes.

Over the past four months, the world has continued to shock us as unforeseen circumstances unfold. This has created a more volatile and unpredictable economic environment and a big question remains:

Is the real estate market in central Florida due for a price drop or adjustment?

It is challenging to predict, but some factors that directly influence the market can be analyzed in the hopes that trends become noticeable.

The three significant points are the market of mortgage interest rates, supply of, and demand for homes.

Increasing Mortgage Interest Rates

According to Mitch Strohm, “Today [April 8, 2022], the average rate on a 30-year fixed mortgage is 5.09%, according to Bankrate.com, while the average rate on a 15-year mortgage is 4.21%. On a 30-year jumbo mortgage, the average rate is 5.03%, and the average rate on a 5/1 ARM is 3.43%.” This, it can be argued, may be a contributing factor to the much-anticipated drop in property values.

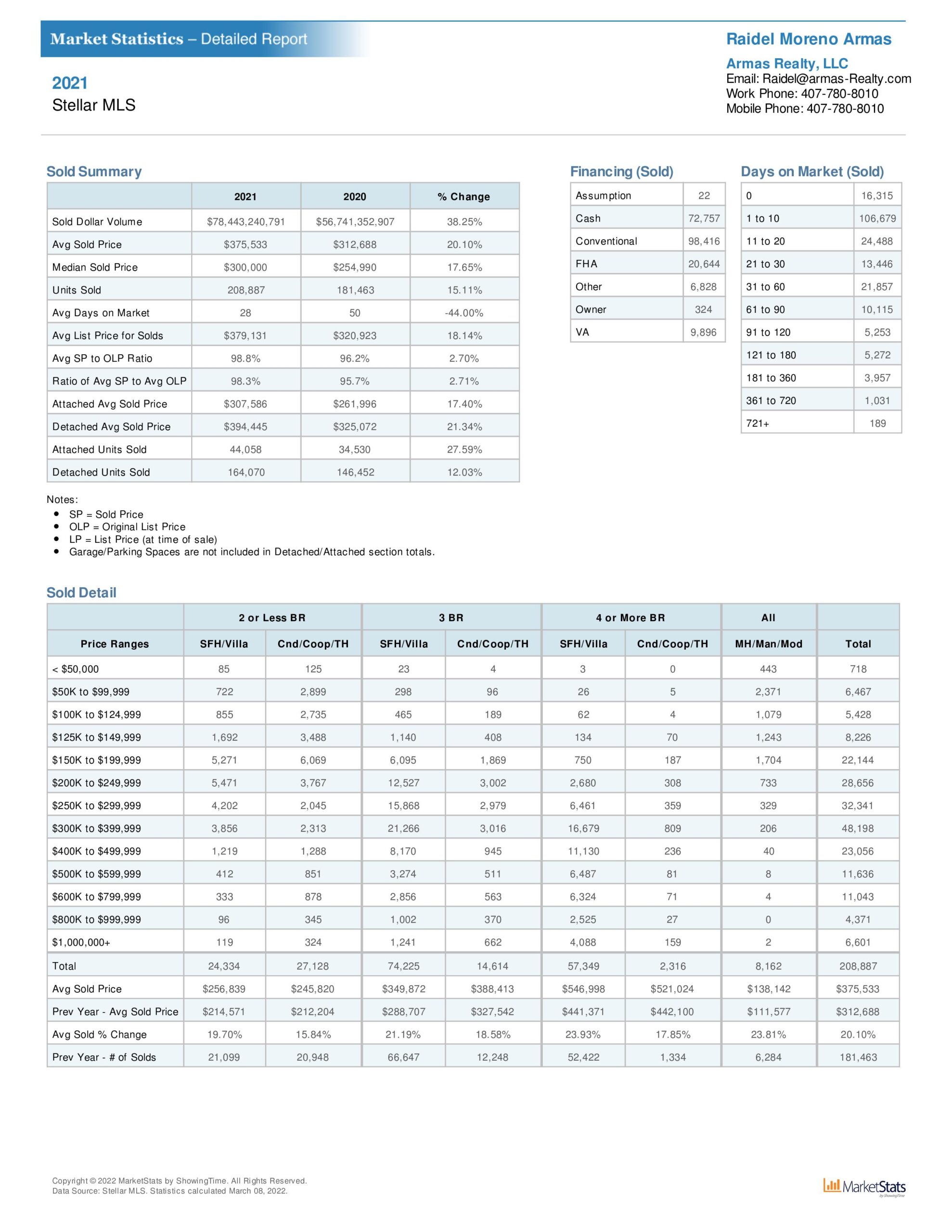

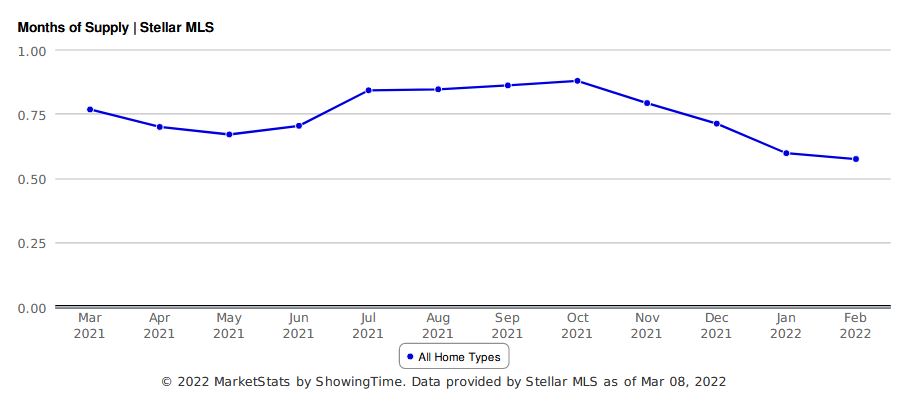

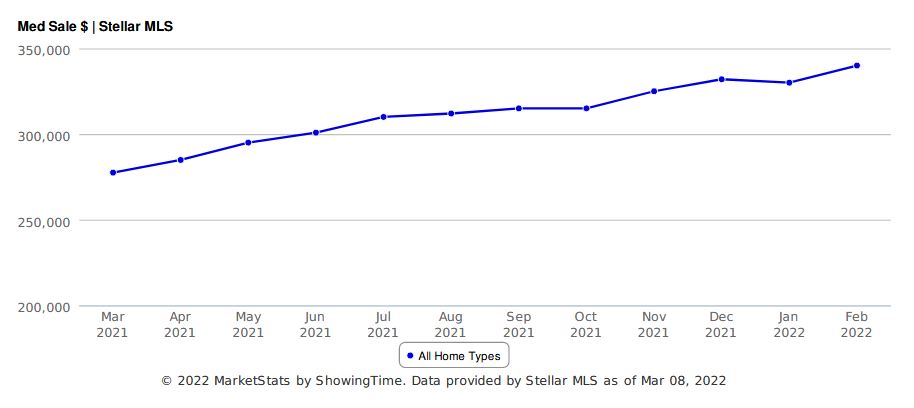

According to data from Stellar MLS of all the sales from 2021 and year to date for 2022, on average 36% of all property sales in the region, were cash sales or nontraditional loans. Furthermore, for the past year, the inventory of months has remained below one month of supply. If no new homes entered the market, all current homes for sale will sale in under one month.

This means even if interest rates continue to fluctuate upwards, it may take a few months for these increases in interest rates to have a negative or downward push on property prices.

Historically Low Inventory

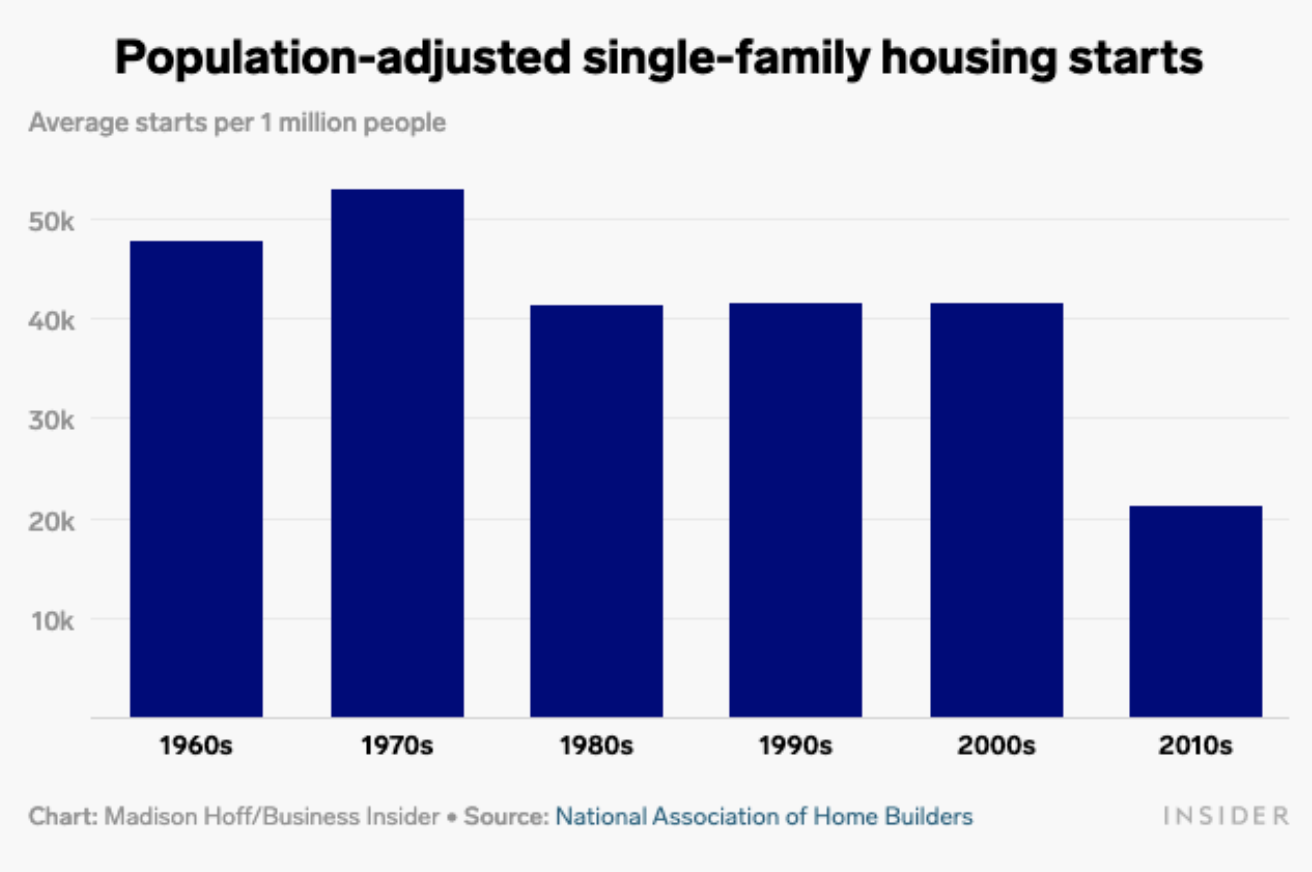

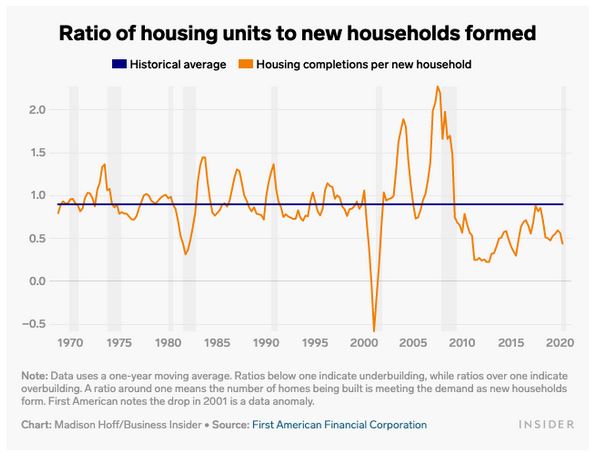

In a Business Insider article by Madison Hoff, in order “to see if the US has been keeping up with new construction as the population increases, the National Association of Home Builders adjusted single-family housing starts for each decade by the size of the population.”

Using their calculations the following chart highlights the population-adjusted single-family home starts averaged over each decade:

This chart offers one explanation of why we have had less than a month’s inventory over the past year. Another explanation Hoff offers is that “older adults seem to want to age in place, more so than in previous years, which affects available inventory. NAHB found that in 2012, 32% of remodeling homes were due to aging-in-place reasons, and this number rose to 52% in 2018.”

Increase Availability of Remote Work

Another factor driving property values up is the rise in permanent residents moving to Florida.

This is a result of COVID and the increasing popularity of working from home. According to an Orlando Sentinel article by Jim Saunders, “Florida trailed only Texas in population increases from 2020 to 2021…” “Florida grew by 211,196 residents from July 1, 2020, to July 1, 2021, to a population of 21,781,128, the census estimates show.” Florida had the largest net migration gains in the country.

Changes in the way that we all perform and show up for work have changed our priorities as well as allowed us to uproot our families and migrate. Many new residents moving from states such as California are making the move to reduce their tax obligation and increase their disposable income, leading to an increase in demand for homes.

Final Thoughts

Although many continue to patiently wait for a price drop, all of the evidence and data point to the contrary. We can all agree that a price adjustment is due in the coming years. However, what this means for property values is yet to be determined.

A price adjustment does not necessarily equate to a drop in prices. It may mean that prices plateau for a while. It may also mean that the inventory increases, leading to a balanced market. According to Showingtime, a balanced market typically lies between four and six months of supply.

Until then, like I always tell my customers and agents, it is better to buy and wait than wait to buy. The former will add an asset to your investment portfolio with the potential for compounding returns over time.